Insurance is probably the most clever business scheme ever devised by humans. In one sense, insurance is a form of gambling (cost/benefit based on statistics), a clever way for people to make a profit by selling peace of mind (unless you truly need it unexpectedly someday), and is increasingly a government mandate. Insurance policies are so complex today, that consumers buy them and agents sell them without really understanding them, and consumers may never actually need some of the coverage! On the other hand, there are some types of insurance that people should own, but do not, notably short-term disability insurance. There are many types of insurance, and there is now insurance for almost any form of protection you can imagine: pet insurance, extended product warranties, personal cyber-bullying insurance, identity theft insurance, drone insurance, ride sharing insurance, home sharing insurance, and the list grows every month. Buying into all of these forms of insurance, you could protect yourself into poverty!

Insurance is probably the most clever business scheme ever devised by humans. In one sense, insurance is a form of gambling (cost/benefit based on statistics), a clever way for people to make a profit by selling peace of mind (unless you truly need it unexpectedly someday), and is increasingly a government mandate. Insurance policies are so complex today, that consumers buy them and agents sell them without really understanding them, and consumers may never actually need some of the coverage! On the other hand, there are some types of insurance that people should own, but do not, notably short-term disability insurance. There are many types of insurance, and there is now insurance for almost any form of protection you can imagine: pet insurance, extended product warranties, personal cyber-bullying insurance, identity theft insurance, drone insurance, ride sharing insurance, home sharing insurance, and the list grows every month. Buying into all of these forms of insurance, you could protect yourself into poverty!

Insurance is not a financial investment. Insurance is a means of transferring risk away from the insured to the insurance company.

Five general questions to ask yourself for determining whether or not you need any specific type of insurance are:

- Does the law require it? If so, then how much insurance do I really need or desire to meet the legal requirements and to have sufficient peace of mind about this?

- What is the worst possible thing that could possibly happen to the person or thing I am considering insuring?

- What is my best estimate that this worst event will happen to the person or thing I am considering insuring?

- How content would I be without insurance if this worst thing happened to the person or thing I am considering insuring?

Shopping for Insurance

You can shop comparatively for various types of insurance using an independent insurance broker at TrustedChoice.com, PolicyGenius, Insure.com, or AccuQuote.com.

Proper Use of Insurance

There is a proper and improper way for you to “use” your insurance. The improper way is to file a claim each time you experience a damage or injury incident. This seems like a good way to get your money’s worth from your insurance premiums; however, this will backfire on you. Most insurance companies will raise your premium each time you file a claim, regardless of how small that claim is.

The proper way to use auto insurance is to file an insurance claim only for significant incidents, such as a major auto accident involving medical injuries, auto damage and property damage that significantly exceeds your deductible. So, you need to carefully weigh the pros and cons to your selected deductible.

There are many types of insurance to consider for protecting your life, family, friends, guests, innocent bystanders, lifestyle, and property. It is important to purchase the right type of insurance per each stage of your life and just the right amount of each component.

- Auto Insurance

- Long Term Care Insurance

- Life Insurance

- Homeowners Insurance

- Disability Insurance

- Health Care Insurance

- Dental Insurance

- Product Warranty Extensions

- Annuities

- Umbrella Insurance

- Direct Primary Healthcare

Auto Insurance

Shopping for auto insurance? The top-rated auto insurance companies are USAA (for veterans only), Amica, and Erie. There are several components to auto insurance, some *required by law, other optional:

- Premium: The premium is the regular payment that you are responsible to pay. You may pay monthly, quarterly, semi-annually or annually. By paying annually or semi-annually, your premium will likely be lower.

- Deductible: The deductible is the amount that you are responsible to pay out of your own pocket before the insurance company takes on their responsibility to pay the remainder of the damage. The deductible amount is determined by the amount you selected in the policy. The higher your deductible, the lower your premiums. You want to choose the highest available deductible amount that you can afford to risk. You need to carefully weigh the risk of having an accident and having to pay for repairing your vehicle with your own money with the risk of not affording to paying your insurance premium. If you drive very little, in a low traffic area and are a very careful driver, you should consider selecting a high deductible. On the other hand, if you drive very much, in a high traffic area and are not very careful driver, you should consider selecting a low deductible.

- *Liability: Liability covers the cost of injuries and property damages caused to others than yourself as a result of the accident. This component is required by state law.

- *Bodily Injury: This covers items like medical costs, lost salary to others, and repairs to other peoples’ property as a results of the accident. This component is required by state law.

- Collision Coverage: Collision covers the cost repairing your vehicle in the event of a collision with an object or another vehicle. This component is optional.

- Comprehensive Coverage: This component covers incidental events other than a collision, such as vandalism, theft, fire, flooding, hail and other falling objects. This component is optional.

Some other optional auto insurance coverage items that are available:

Medical Payments

This pays you and your passengers for medical and funeral expenses incurred in an auto accident, regardless of fault. It will also cover injuries sustained by you while you’re operating someone else’s car (with their permission), in addition to injuries you or your family members incur when you are pedestrians.

Personal Injury Protection (PIP)

This is the name usually given to no-fault benefits in states that have enacted mandatory or optional no-fault auto insurance laws. Personal Injury Protection usually includes benefits for medical expenses, loss of income from work, essential services, accidental death, funeral expenses, and survivor benefits.

No-Fault Insurance

Many states have enacted auto accident compensation laws permitting auto accident victims to collect directly from their own insurance companies for medical and hospital expenses regardless of who was at fault in the accident. Although there are many legal variations of no-fault insurance, most states still allow people to sue the negligent party if the amount of damages exceeds a certain state-determined threshold.

There are also other extra items, such as rental reimbursement, towing and labor charges in case of a breakdown.

As your vehicle ages, you should check annually to see its Blue Book value, as it will be depreciating annually. When your vehicle depreciates in Blue Book value to about 2x the cost of a major repair, you should consider dropping the collision component from your insurance policy if you wish to save a little money. This is the point where, if the vehicle needed a major repair (transmission, engine, etc.) coasting over $2,000, you would likely choose to junk it and buy another vehicle. If you live in a region where the threat of damage from natural disasters, vandalism and theft is low, you might also consider dropping the comprehensive component as well. Of course, before dropping either of these, you should first check with your insurance company to see how much money each of these components is costing you. If they are inexpensive, it may pay to keep the coverage.

If you have included the towing option to your auto insurance and use it at your first roadside break-down, your premium will be raised, effectively charging you for your towing service, plus extra. If you file a claim the first time you have a minor scratch, or fender-bender, the insurance company will likely raise your premium. So, it really does not pay you to file a small claim or to add the towing option. It is better to not add the towing option.

As of 2/6/2021, Nationwide offers an insurance plan called Smart Miles that factors in the amount that you drive, so if you drive very little, you could save a lot of money!

Another plan for light drivers that’s worth checking out is Metro Mile; however, it’s currently available in just eight states.

Driving on the One-Way Street of Loyalty

Do you pride yourself for being a loyal insurance customer? You should know that generally, most auto insurance companies (and some other insurers) will reward your loyalty for staying with them over the years by jacking up your rates! That’s right! Their customer data informs them that they can make more money by exploiting their loyal, passive customers! So my recommendation is to research the insurance market about every five years. If you find a better deal (I am confident you will), make the switch! But just be sure you are comparing apples to apples with equal coverages and deductibles. Also, compare smaller, mid-west companies with the large corporations.

Pay-Per-Mile Insurance

If you drive less than about 12,000 miles per year and are paying a lot for auto insurance, you may save a lot of money by having your premiums set on a mileage basis. With this payment structure, the more you drive, the higher your premiums. Compare your current rates with the rates of MetroMile.

Long-Term Care Insurance

Long-term care insurance is probably the most complex construct of any insurance policy. To be an informed consumer and smart citisumer, you must learn the LTC insurance lingo, policy features, and your most probable future care needs. Actually, you probably only should purchase LTC insurance if your total assets are between about $1-2 million. If they are less than $1 million, you probably cannot afford it; if they are over $1 million, you can probably afford to pay your long term care bills with a longevity annuity or cash.

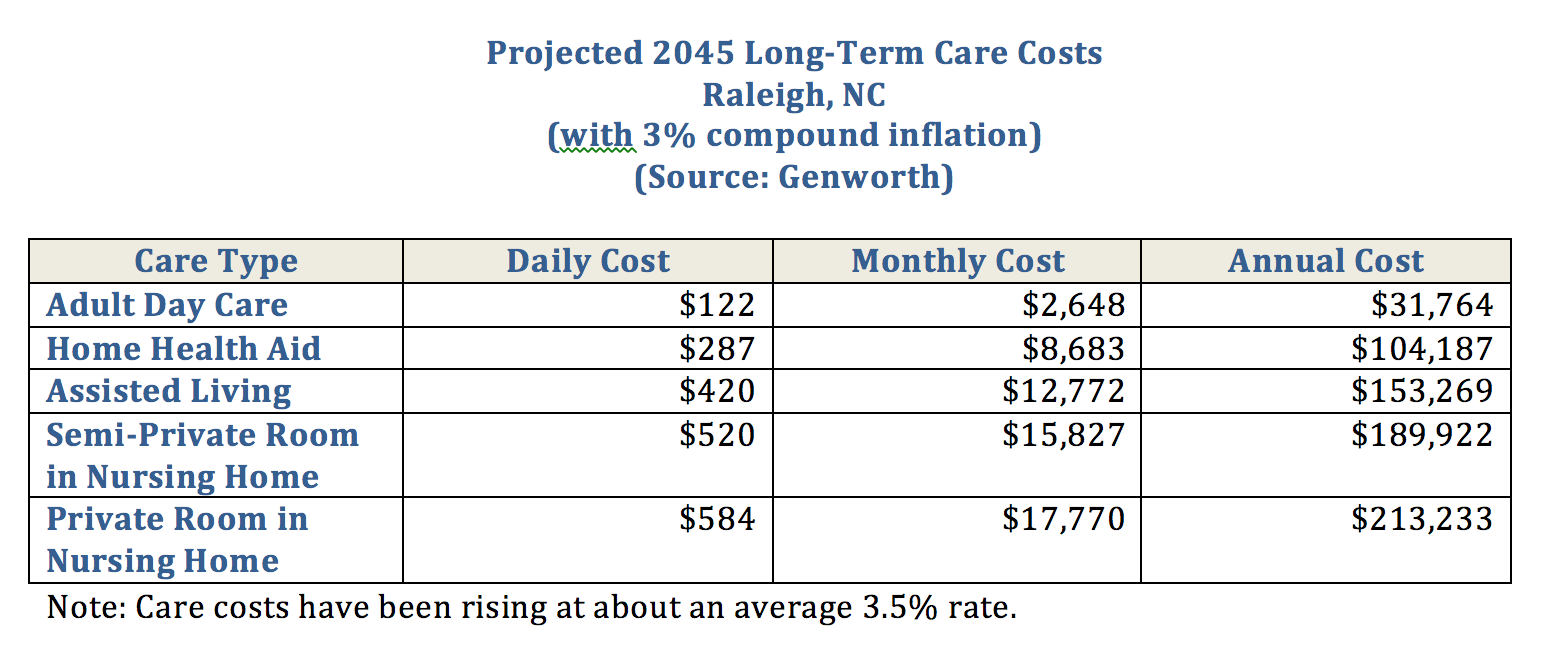

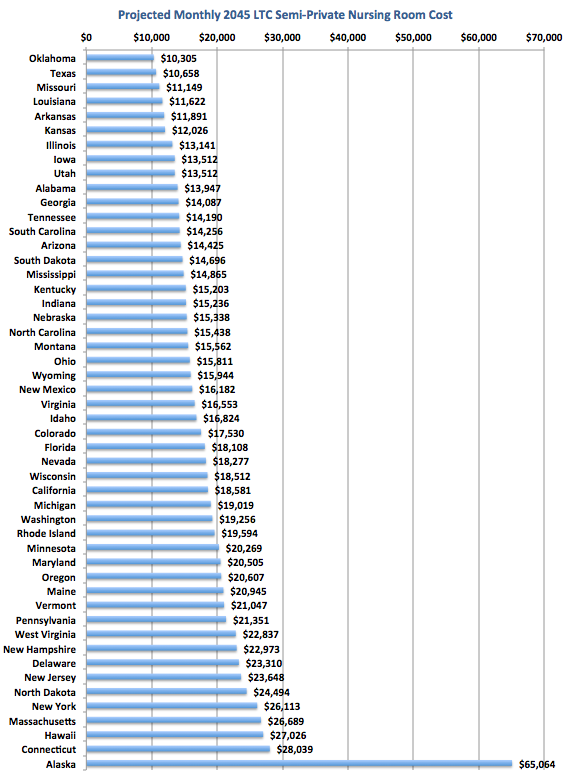

Currently (2018), the average cost of a semi-private room in a nursing facility is $8,152 in Florida and $6,494 in Arizona. Care costs have been rising at about an average 3.5% rate. Genworth projects that in 2045, the average monthly cost of a semi-private, long-term care room in a nursing home in Florida will be about $18,108; the average cost of that same care in Arizona will be about $14,425. LTC costs vary significantly by state, city, care facility type, and specific facility, but LTC insurance costs vary likewise. Medicare and health insurance will pay only a very small percentage of LTC costs, and Medicaid will only pay for LTC after you have spent all of your own money. Healthcare and insurance costs vary greatly by age, state, care facility, and health condition. You can research the current and future cost of various types of care by selected cities, states and years at Genworth.

Statistically, there is a high probability that at least one member of a married couple will need LTC at some point in their life. See Kiplinger’s LTC insurance dilemma and statistics at Morningstar.

The average duration of long-term nursing home care for physical disabilities is about 2.5 years. Care for cognitive disabilities (Alzheimer’s, dementia, etc.) requires a much longer duration of care of about 7 years.

If you determine that you need LTC insurance, a few initial questions to answer are:

- Based on your own and your parents’ medical history and biology, what is the chance that at least one of you will need LTC insurance one day?

- What is the chance that one day one of you will need LTC care for dementia, Alzheimer’s, or other cognitive disorder that requires several more years of care than would a physical disorder?

- How much of a burden do you want to place on your spouse and children to care for you or your spouse (or both) one day?

- Roughly, what % of your care expenses do you want to pay out of your own pocket using your own money? 0%, 10%, 20%, 30%, 40%, 50%?

- How much does long-term skilled nursing care currently cost in your retirement city today? How much will it likely cost when you are 80-85 years old (including 3-4% compound inflation)?

- How much long-term care insurance coverage can you afford to pay annually over the next 10 or more years?

- How willing are you to relocate far from your children, church and friends to secure more affordable long-term care?

Personally, I recommend a licensed, faith-based, non-profit care provider, as these are more affordable, and less likely to kick you onto the street if/when your money runs out! And they will tend to care for you better, with less chance of physical abuse.

Genworth has projected the 2045 cost of long term care by state. The two states with the least expensive long-term care costs in a semi-private nursing home are Oklahoma and Texas. Arizona’s projected costs are near the average state cost point.

The ideal time to purchase LTC insurance is approximately age 57-62; however, a policy with a fixed term of, say 10 years. may save you money by acquiring a few years sooner, as premiums increase significantly with each passing birthday. If you wait until your mid-late 60’s, you may become uninsurable to most insurance companies. Also, beware that many traditional insurance companies use your next, up-coming birthday to compute your age-based premium, not your current age!

The long-term care (LTC) insurance industry is currently in a major transition. Many major providers have closed, with only a few remaining. Many insurers failed to foresee their clients’ health improve with advances in medical science and technology, reduction in smoking, improved dieting, and the resulting increased lifespans. Their policies were essentially bets that their clients would not live long enough to file expensive LTC claims. When their clients lived long enough to maintain LTC insurance claims en masse, many companies went bankrupt.

If considering a traditional long-term care insurance policy, be aware that many providers can and will raise your monthly premium on you by as much as 10-20% after several years. Many policyholders, not expecting this, will respond by dropping the insurance altogether because they can no longer afford the payments. The end result is that most, if not all of their previous payments, perhaps over a 10-15 year period will be lost. However, there are a few insurance companies that have a history of rarely having raised their premiums: Mass Mutual, New York Life, and Northwestern Mutual; however, unless there is a written guarantee in the policy, there is always the possibility they will be forced to raise their premiums in the unforeseeable future. For now, perhaps the best available, affordable, traditional LTC policy is the Mass Mutual Signature Care MM-500 2013 policy. This comprehensive care insurance policy has a 3-year benefit period and is a tax-qualified, Medicaid partnership plan (with pooled benefits) that can protect you personal assets from being consumed initially by long-term care before Medicaid benefits kicks in.

However, if such a basic, limited traditional plan is not sufficient for you, there is a new breed of LTC policy now available that you should consider: hybrid Whole Life/ Long-term Care insurance.

Unfortunately, this is not the best time to purchase LTC insurance, so if you can wait a few years, new LTC insurance providers and plans should become available. So, if you are in your 60’s and cannot wait, here are your options:

- Purchase a traditional LTC policy around age 57-60

- Purchase a fixed premium, hybrid whole life/LTC insurance policy around age 60

- Purchase a longevity annuity around age 60

- Purchase an immediate annuity around age 75-80

- Purchase a whole life insurance policy with a chronic illness rider (option)

- Create your own investment savings fund, dedicated to retirement care expenses.

- Get your loved ones to agree to care for you until your death

- Settle for professional, at-home care until your death, or until you can afford to transition to a nursing facility

- Relocate to another state where the cost of long-term care is relatively low

- Relocate to another country (Costa Rica, South America, Central America, Philippines, Belize) where the cost of living is very low.

You may utilize some combination of the above options. For example, you might purchase a hybrid LTC/Life insurance policy and/or a longevity annuity, relocate to Texas, and utilize professional at-home care with assistance from your spouse for as long as possible before transitioning to a skilled nursing home.

Currently (as of 2018), your best option may be either a hybrid life/LTC insurance policy or a longevity annuity. Hybrid LTC insurance policies can be flexibly used as a life insurance policy and/or a LTC insurance policy. Hybrid policies generally require a much less stringent medical background investigation than traditional LTC insurance policies, consisting of a questionnaire survey form and a telephone interview that includes a cognitive test of your metal abilities. Another option is a hybrid longevity annuity/whole life Insurance policy, but, as of 2018, such a policy is more expensive, with a lower benefit.

These hybrid policies are complex, and confusing. In fact, they are so complex, there are insurance sales agents who sell them, and consumers who buy them without fully understanding them! Right now (2018), the best deals on long-term insurance is probably an Asset Care IV hybrid policy from OneAmerica. Another company’s hybrid policy worth considering is Minnesota Life’s Secure Care Policy. More, better policies may become available over the next few years.

I chose OneAmerica’s Asset Care IV hybrid policy. This policy offers the following major features:

- Full-spectrum of care type coverage, including home health care, adult day care (by a professional), assisted living, long term care facility, hospice, and foster care.

- Lifetime, unlimited benefit period, with benefits that can be shared (stolen) between spouses as desired.

- Fixed premium that is guaranteed, in writing to never rise, (unlike traditional LTC insurance).

- Premiums cease after 10 years (if you choose their Asset Care IV plan). Premiums cease if/when you reach age 100 and still do not need long-term care (if you choose their Asset Care I plan).

- Pays a fixed, monthly benefit per individual.

- A whole life insurance death benefit that is paid to the beneficiary upon the death of all persons in the policy, if the policy holders never need long-term care. This benefit is consumed during months 3-27 of long-term care needs (beginning at the end of the 2-month elimination period).

- 60-day elimination period: The gap period of time between when your doctor declares that you cannot perform 2 of the 6 established daily living activities and when the insurance company begins paying your monthly benefit.

- 3% compound inflation protection option (a.k.a. “rider”).

- A+ rating by A.M. Best: You need a stable insurance company that you can be assured will still exist when you need it in 25 years.

- If you decided to cancel the policy after investing some or all of the premiums, you should receive a refund of at least 60% of your total premium payments (80-90% of the base portion), perhaps more, from the 4% appreciation your money has experienced from its investment by the insurance company.

LTC Insurance Jargon

To make an informed choice of LTC insurance, it is essential that you understand the insurance lingo jargon. Here is a glossary of long-term care jargon that you need to understand to informatively select a policy. I am convinced that this jargon is intended to place the consumer at a disadvantage when shopping for insurance!

- Whole Life Insurance: Life insurance that covers the entire remainder of your life, with no end date.

- Premium: The periodic payment you must make to maintain your insurance policy. This may be a one-time lump payment, annual, quarterly or monthly payment. By contracting to pay once or annually, you not only get a discounted total premium, but a fixed-term policy!

- Benefit: The monthly amount of money paid by the insurance company to reimburse you for your care costs.

- Death Benefit: The amount of money your beneficiary will receive upon your death.

- Beneficiary: The individual that you choose to inherit the death benefit upon your death.

- The six daily living activities (DLA’s): The six living activities that people must perform daily to survive. These include bathing, continence, dressing, eating, toileting, and transferring in/out of bed or wheelchair. The insurance elimination period typically starts when your licensed physician declares in writing that you can no longer perform two of these six activities, thus qualifying you for long-term care. Bathing is typically your first activity to lose the ability to perform.

- Elimination Period: The wait time period from the time your doctor declares that you qualify for long-term care to when the insurance company benefits begin to kick in. The time that you are on your own for paying for care out of you own pocket. The longer the selected elimination period, the lower your premium.

- Base: The component of the policy that can be used to pay for long-term care care or death benefit. The component/period of the policy during which your life insurance is being consumed to pay for your care.

- Acceleration Rate: The rate at which your life insurance is being consumed to pay for care. The faster you can consume this, the faster you will arrive at the COB period, where the insurance company begins paying the full benefit; however, you consume the death benefit in the process. The higher the acceleration rate, the higher your premium.

- COB (Continuation of Benefits): The period/component of the policy where the insurance company pays the full monthly care benefit. This period is activated when your life insurance base/death benefit has been completely exhausted by paying for your care.

- Rider: An option available at additional cost. Adding an inflation rider to your policy will add to the policy’s cost, but this rider is essential to keeping the policy up with inflation and cost-effective!

- Forfeiture: Canceling your insurance policy and getting part of your money back.

- Cash Surrender Value: The amount of money you will receive when you cancel your policy.

- Surrender Charge: A fee charged against you for canceling the policy, forcing the company to surrender money to you.

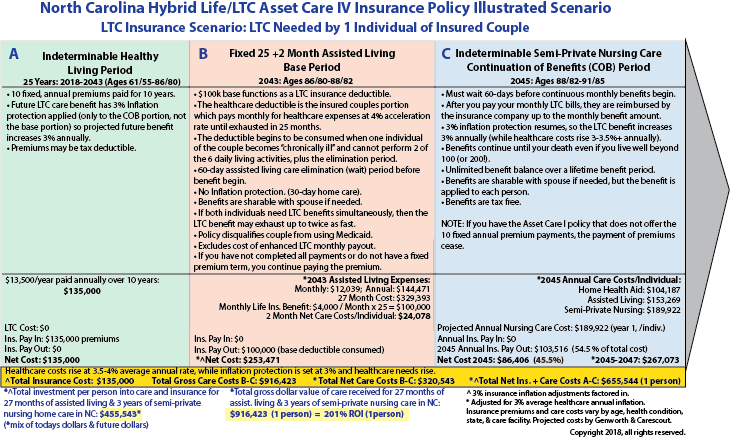

Let’s first look at how the OneAmerica Asset Care IV hybrid policy functions as a LTC insurance policy, by viewing the diagram below. This scenario is for a healthy, married couple, Greg and Gail Jones, residents of North Carolina, ages 61 and 55 respectively in the year 2018. I recommend that you copy/paste and enlarge/print this important diagram!

Long-Term Care Insurance Scenario

Period A: The couple signs the insurance policy contract, agreeing to pay a single annual premium of $13,500 per year (guaranteed never to increase) for 10 years for a total of $135,000. The insurance company invests this money into bonds and 4% of this investment is divided and applied to your base death benefit and Continuation of Benefits (COB, is used for care after the base death benefit has been consumed). So, Greg and Gail retire healthy and continue to pay their annual premium for 10 years. After living in retirement 14 more years and paying no premiums, Greg suddenly passes away of a massive heart attack, without needing any long-term healthcare. Gail continues continues living for 3 more years, when her physician documents that she can no longer bathe and toilet safely (2 of the 6 daily living activities) and needs to move to an assisted living facility.

Period B (2043): At this point, the 2-month elimination period begins, meaning that Gail will not begin receiving any insurance benefits for 2 more months. So Gail moves into an assisted living facility, where she must pay the full care bill out of her own pocket for the first 2 months. This sounds unfair, but hey- that’s the term of the policy that she agreed to! After 2 months pass, the LTC insurance company begins to pay a fixed 4% of the compounded 3% inflated $100,000 base deductible, with the inflation protection temporarily paused during this period.

Period C (2045): After 25 months and the $100,000 base deductible is exhausted, Gail’s benefit advances to a skilled nursing facility, where the insurance benefits continue indefinitely, now WITH a 3% inflation protection. With the contracted benefit amount, these benefits are projected by Genworth to cover approximately 51% of her nursing care needs in a semi-private room (for this illustrated policy, age, and in Raleigh, NC).

Notes:

- If Gail lives to age 200 (or more), she will continue to receive the monthly insurance benefit, with a 3% compound annual inflation increase. However, historically, the cost of healthcare has risen 3.5-4% on average annually.

- If both Greg and Gail both needed care simultaneously, they would have consumed the $100,000 base deductible up to twice as fast, then would each receive the same benefit amount as Gail did alone.

- If Gail had passed away before the $100,000 base deductible was completely consumed, her beneficiary would have inherited the balance, up to the full amount of $100,000.

- If Gail needed care before the 10 annual premiums were paid, she would need to continue paying the balance of her premiums.

- If Greg had needed long term care, say 5 years into their policy, when they had only paid 50% of the total premium, Greg would have received about 90% coverage, but would still need to pay the remainder of the annual premiums.

- If inflation had risen more than 3% during periods A & B, the benefit would have covered less % of the care costs. A 4 or 5% inflation rider is also available, but this is prohibitively expensive.

You can opt for a similar hybrid policy (OneAmerica Asset Care I) that has a much lower monthly premium. However, such a policy requires one large, up-front initial premium ($50,000 or more), and your monthly premium payments will not end until you need care AND after your $100,000 death benefit base has been completely consumed by care expenses.

Whole Life Insurance Scenario

Now, let’s look at the whole life insurance component of the hybrid LTC policy.

Period A: This functions the same as with the LTC scenario, with no changes to costs.

Period B: This functions the same as with the LTC scenario, but ends with the passing of 1 individual of the couple. Greg abruptly passes away without using any of the $100,000 base deductible for healthcare. So, in this case, the base $100,000 remains unused. If Gail, the surviving insured individual needs healthcare, the base may function as a LTC insurance deductible. If Greg had died after consuming part of the base deductible for healthcare, Gail could use the balance of the base deductible for healthcare if needed.

Period C: Gail develops Alzheimer’s and her doctor declares that she cannot perform 2 of the 6 daily living activities, and therefore must be admitted to a nursing home. During the first 2 months (the elimination period), Gail must pay all care costs out of her own pocket. Beginning month 3, the $100,000 base deductible (aka, life insurance benefit) begins to be consumed to pay for nursing care costs at a fixed, 4% monthly rate. At this rate, the base will become exhausted in 25 months. Unfortunately, Gail passes away after just 10 months of care, consuming some of the base. Gail’s beneficiary, her daughter Brenda, inherits the balance of the base.

Notes:

- If Greg had needed $100,000 worth of care before passing away, all of the life insurance benefit would have been consumed, leaving no life insurance benefit for their beneficiary.

- If Gail had passed away abruptly before being admitted to the nursing home, her daughter would have received the full $100,000 life insurance benefit upon her death.

- If Gail had resided in the nursing home for more than 27 months (2 + 25), her daughter would not have received any life insurance money, as the base would have been exhausted.

The above chart may help you to decide how much insurance to purchase.

Bottom Line:

Estimated ROI: 201% for the illustrated time period, if just 1 person needs care

Annual, Cost:Benefit Ratio: 54.5% of total semi-private nursing care care costs

Lifetime, unlimited, shareable benefit of $4,000/month, per individual

Fixed, annual premium paid for 10 years

Potential $100,000 whole life insurance benefit

Total Insurance Cost: $135,000

You probably should not consider purchasing enough of this insurance to cover 100% of your care needs if you have other sources of savings or income during retirement. If you think this hybrid LTC/Life insurance plan is expensive, you’re right, but consider these facts:

a. The incidence of cognitive disabilities such as alzheimer’s and dementia are rising. People with cognitive disabilities average about 7 years in nursing homes. Such incidence is rising.

b. This insurance plan provides benefits for the remainder of ones life, beginning 27 months after losing two of the daily living activities. This feature is HUGE!

c. This plan has a fixed, published price tag; after paying a fixed annual premium for 10 years, the policy is paid in full. This feature is HUGE!

d. The policy can actually be cheaper than its price tag! By paying one premium annually over 10 years, you can have the future premium payment dollars invested and earning 6-10%, effectively paying for some or all of your future premiums!

e. Statistically, chances are that at least one individual of a couple will need long-term care, making this policy a good investment, with a positive ROI. If no one on the policy needs long-term care, your beneficiary receives a large benefit upon the death of the second spouse, so someone gets something big out of this policy regardless of how your care needs play out.

f. Hybrid policies like this one generally requires a much less stringent medical background investigation than traditional LTC insurance policies.

g. Healthcare and insurance costs vary greatly by age, state, care facility, and health condition.

Due to its fixed premium and 10-year, fixed payment term, the ideal age to purchase this type of hybrid policy is around ages 55-60. Imagine having this policy paid for by the time you retire! By contracting at a younger age, say 55, your premium(s) should be much lower, and, being healthier, you should ace the mild health check, making your premium still lower! Also, you may have all of your insurance premiums payed by the time you are ready to retire! The drawback to contracting at a younger age is that inflation may slowly erode your % coverage over time if inflation rises above your contracted compound inflation rider %.

This is just one scenario following one Asset Care IV hybrid policy offered by OneAmerica. You can opt to pay your premium annually, semi-annually, quarterly, or monthly, but there is a discount for paying either a single, lump premium or annually, over a 10-year term. You can select your desired monthly benefit and the resulting premiums and death benefit will adjust accordingly.

Other insurance company polices may function slightly differently, so it is essential that you study the policy terms before signing any LTC insurance contract. If you have a large nest egg and do not need life insurance, then you may want to consider using a longevity annuity to pay for long-term care, or any other retirement expenses. A longevity annuity would provide a more versatile means of paying for daily living expenses, long-term care insurance,a second home, supplemental medical or dental insurance, supplement the grandchildren’s’ college education, or anything else your aged heart desires! The annuity likely has a smaller payout than a LTC insurance policy however.

Probably the best way to shop for LTC insurance is through a certified, trusted and informed financial planner or insurance agent. Mine was a member of my church and he gave seminars on finance and insurance.

Life Insurance

Are you unsure whether you need life insurance, what type and how much? Let’s start with the purpose of life insurance. Life insurance can provide surviving, dependent family members of the death of a breadwinner with a lump-sum payment money to live on. Ask yourself, if I die today, how will that impact my family’s standard of living? If your death will have a great impact on your family’s standard of living, then you need life insurance. If your spouse and children will do fine financially without you, then you do not need life insurance. If you are a single adult, you do not need life insurance, since no one is dependent on you financially. If you are married and both of you earn a comfortable income (say $50k or more annually), you do not need life insurance. Don’t let a slick-talking insurance agent convince you otherwise. Be a smart citisumer!

However, in some cases, life insurance may not be needed, but it would be helpful. Take the above example, where both a husband and wife with no children each earn about $50k per year. If one of them passes away, the other could survive on their $50k income alone; however, their standard of living would be cut in half, and may be slightly or fairly uncomfortable. So, in this case, although not necessary, it might be helpful to have some life insurance, so that a death of a spouse would cut their standard of living by only $25%, or 0%.

So, when deciding on the amount of the death benefit, consider how much of a lump sum payment would provide for an investment in income fund or an immediate annuity that would cover 0-100% of your spouses income.

Next, you need to consider the type of life insurance policy you should get. There are basically 2 types of life insurance: whole life and term life. You should generally avoid whole life insurance and purchase a term life insurance policy. The reason is that whole life insurance does not have a term (termination or ending point). Upon your death, it begins paying your beneficiary (the one you specify in the contract to benefit from your death) until your beneficiary dies. A whole life insurance policy also has a cash value component that grows over time, similar to a savings or investment account. This all may sound great! BUT… consider this- Does your beneficiary really need a large income from insurance to survive for their ENTIRE LIFE, or only until they graduate from college? If the latter, then you only need life insurance to cover your beneficiary for a limited, specified TERM. You need term insurance! Whole life insurance costs about 10 times more than term life insurance, which explains why insurance agents are so aggressive in selling you whole life insurance. Whole life insurance is only suitable for a very small group of people.

So, don’t let a slick-talking insurance agent talk you into a whole life or variable insurance policy that you do not need! YOU decide what insurance you need. Be a smart citisumer!

Homeowners Insurance

Homeowners insurance protects your home from disasters such as hurricanes, tornadoes, hail storms, fires, trees falling onto it. However, do not assume that this will protect it from floods, as flooding is often excluded from such policies. Every insurance policy is unique, so shop around, get at least 5 quotes, specify IN WRITING to the insurance agent exactly what type of coverage you want, then read the quote and final policy to be sure you are satisfied with the coverage before signing the dotted line. You can get a lower premium by raising the deductible (the amount you must pay before the insurance company starts paying a claim). Do not file small claims; only file major claims that are far above your deductible amount. Insurance companies will raise your premium or drop you altogether if you file small claims. The top-rated homeowners insurance companies are USAA (for veterans only), Amica, and Erie.

Renters Insurance

If you live in an apartment or townhouse and share your wall, floor or ceiling with a neighbor, you would be wise to get to know them: how responsible they are with their lives, and yours. If your neighbor smokes, uses candles, has old, frayed electrical cords, and does not use smoke detectors, you would be wise to buy yourself one or more smoke/CO2 detectors. You would also be wise to buy one for your neighbor and annual batteries. You would also be wise to get renters insurance.

Renters insurance is very inexpensive and well worth the cost. Renters insurance will cover the replacement cost of your personal property in the event of a fire or theft. If such an event occurs, it will be your responsibility to prove ownership of each item you wish to claim a loss for. You should take photos of every personal item you might file a claim for and store them in a safe place.

Disability Insurance

Disability insurance is actually a valuable form of insurance to protect you in the event you become disabled for a long time from an accident and cannot perform your job. The insurance is not expensive. If you work in a dangerous job or hobby, it is wise to get disability insurance. Just ask yourself, “How will my family survive if I become disabled?” If you cannot answer this question, then you need this insurance.

Remember to keep yourself adequately covered; while having the bare minimums required by each state may keep you in compliance with state laws, they may not be enough to protect your assets if you have a major incident. Insurance experts recommend that you review your insurance policy often and thoroughly.

Healthcare Insurance

As you probably know, healthcare insurance in America is in a national crisis. A healthcare insurance premium will likely cost $11-14k per year and still rising! The healthcare insurance company that has the highest customer rating today (2018) is Kaiser Permanente. However, there are two possible alternative solutions to consider: direct-primary care and faith-based co-operatives.

Non-profit, Faith-based Cooperatives

If you are a practicing Christian and have a strong personal responsibility attitude, then Faith-based Cooperatives may be a solution for you and your family. They are voluntary, non-profit, cost-sharing ministries. You can think of them as non-profit, healthcare socialist coops. They operate similarly to insurance, but cannot guarantee payment like an insurance plan can. This works like insurance, but instead of the insurance company being responsible for claims, the other members in the coop network are responsible. Fellow Christians help and pray for one another. Members reimburse each other for “qualifying” medical bills through monthly, pre-set financial gifts. This results in low administrative costs. Their reliability is only as good as their customer base and financial pool. But, before you reject this solution, consider this. They are non-profit, Christian, financially sound, growing fast, moral, ethical, caring, prayerful, have a very high payout rate and customer satisfaction rate. Can you say that about your current insurance company? These are all eligible options under the Affordable Care Act mandate (Obamacare).

You can select any doctor you wish, but they should provide you a discount for paying cash. So, you pay cash for doctors’ office visits. You should expect to get large discounts from your medical provider by avoiding all the medical insurance paperwork costs. You need to ask your provider ahead of time if s/he offers a discount to “self-pay” or “cash-paying” customers. If not, first try negotiating with them; then try shopping for a medical provider elsewhere.

There are five non-profit, faith-based healthcare cooperatives available today. The two that are the best quality and value are Christian Healthshare Ministries and Liberty Healthshare:

Christian Healthcare Ministries. Their Gold plan with Brothers Keepers option is clearly the best value!

Liberty Healthshare This coop offers more attractive bells and whistles, and is about 25% more expensive, but is worth considering.

CHM Ministries

Let me use my favorite, Christian Healthshare Ministries as an example. CHM Ministries is my favorite of the healthshares. They are a very low-cost, basic, no frills, healthshare service provider. They have been around since 1981, have an A+ rating with the Better Business Bureau and have good online reviews. They now serve over 142,000 households and are growing fast. They are endorsed by Dave Ramsey and Mike Huckabee.

Their best plan (Gold plan, which I recommend) costs $150 per person (unit) per month, plus $25 per quarter per person. This give you $125,000 sharing support per illness that costs more than $500. So, any medical costs under $500 you must pay yourself using cash. Their inexpensive Brothers Keepers option gives you unlimited sharing support per illness incident.

So, for a family of 4, it would cost $600 per month for the Gold plan, plus $100 per quarter for the Brothers Keeper option, plus some small, miscellaneous fees. Medical discounts can potentially eliminate all out-of-pocket expenses. So, don’t balk about having to pay for medical bills under $500, when you are saving tons of money overall! Focus on the grand, annual total!

Costs are not adjusted based on age, weight, medical condition or history, regardless of your age and medical condition, the price is the same. No one is denied or dropped participation due to medical conditions! They will gradually, over 3 years, accept pre-existing medical conditions. You can go to any specialist without a referral. Their plans include a prescription, eye, hearing, chiropractic, and physical therapy ($45 per incident). You can get a discount dental plan for $200 per year. You will need to do the billing and claim paperwork yourself (if this turns you off, look into Liberty Healthshare, who will assist with this). Unfortunately, using an HSA account with this is illegal; thank your congressional representative for this.

Liberty Healthshare

Liberty Healthsare is my 2nd favorite. They are a low-cost, faith-based, non-profit, healthshare service provider. They have been around since 1995 and have good online reviews. They now serve over 210,000 members and are growing fast as a result of the skyrocketing costs of traditional health insurance. Although not legally “insurance,”, the programs cover eligible medical care includes doctors office visits, inpatient and outpatient hospital treatment and surgery.

Their best plan (Liberty Compete, which I recommend) premium costs about $150 per person per month. Deductibles are $1,500 for a family of 3 or more, $1,000 for a couple and $500 for an individual. This give you $1 Million sharing support per incident. So, any medical costs under your deductible you must pay yourself using cash. As a cash-paying patient, you should receive significant discounts for medical care for eliminating insurance and billing paperwork, staff and bureaucracy. Your medical provider will handle the small amount of electronic billing with Liberty.

Any medical expenses beyond your deductible are submitted directly to the pool of shared members for payment. As a member, you commit to using your shared dollars to pay the medical expenses of a selected member in need, as well as praying for them.

So, for a family of 3, it would cost $450 per month for the Complete plan, plus application/renewal fee, and other smaller, miscellaneous fees. If you need to subscribe to their HealthTrac program, add another $80/month per person. Medical discounts can potentially eliminate all out-of-pocket expenses. So, don’t balk about having to pay for medical bills under your deductible, when you are saving tons of money overall! Focus on the grand, annual total!

Plus, with Liberty, you can choose your own traditional primary care physician or subscribe to a direct primary care doctor for a monthly rate of $50-100/month and get superior medical service! If you are not familiar with this, you need to learn more about this! Liberty will pay $40 per month for this subscription.

You can go to any specialist without a referral.

Plus, included free in the plan, you get a discount plan that covers dental, tier 4 pharmacy prescriptions, eye care, chiropractic,

Also provided is a 27/7 nurse Hotline!

No one is denied or dropped participation due to medical conditions! If you have a pre-existing medical condition, they may require you to subscribe to their temporary HealthTrac program for $80 per month. HealthTrac℠ is designed to help individuals overcome issues with diabetes, hypertension, cancer, heart disease, high cholesterol, obesity, and tobacco dependency. Each HealthTrac℠ participant is assigned a Health Coach to develop a personal plan for achieving goals related to their condition or diagnosis.

The plan also provides limited, end-of-life financial assistance.

Unfortunately, using an HSA account with this is illegal; thank your congressional representative for this.

We considered both CHM and Liberty. We found that by using CHM healthshare with a local DPC physician, the combination provided us with a complete and affordable health solution that was superior to traditional insurance and physician plans. The dollars we saved by subscribing to CHM, we applied toward the DPC. So, the key is to balance your expenses between healthcare insurance and health care.

Prescription Insurance

You may be surprised to learn that you can probably get prescription drugs significantly cheaper by using RXSaver or GoodRX over your own medical insurance plan’s prescription drug coverage.

Dental Insurance

Unless you have an unusually great need for dental work, the cost of dental insurance may be too high. A more reasonable alternative suitable for most people is a dental discount plan. Most dental discount plans are junk, but a few are worth their low cost. Perhaps the best or one of the best is offered by Careington. They should offer a large discount on their subscription on Black Friday and holidays.

Product Warranty Extensions

Extended warranties are often pitched when buying electronics and appliances. Generally, product extension insurance warranties are a waste of your money. A device with a short or limited warranty suggests poor quality. If you intend to keep it for a long time, then it is wiser to buy a quality brand and model. If/when the device breaks, it is probably time to buy a new model. The only exception may be when purchasing a refrigerator or used vehicle that has a very limited warranty. However, a better idea is to open a dedicated savings account with a credit union and depositing $5-$20 each month. Then, when you need a new appliance or auto, use the money in this account to replace the item.

Annuities

You’ve no doubt seen or heard commercials advertising “guaranteed income” investments. They never mentioned the word (intentionally), but they are all referring to annuities. You may not know anything about annuities, or you may have heard about annuities; that they have many, high, hidden fees. Generally, this is true. Let me tell you the truth about annuities.

You may wonder why annuities are listed here with insurance products. Annuities are, in fact, insurance products to provide you security and peace of mind, not just income. Annuities are not investments; they are insurance products. Never shop for investment products with an insurance company or a bank and vice versa.

There are several types of annuities: fixed annuities, index annuities, variable annuities. These are all bad, bad, bad for you and good, good, good for the insurance sales agent! They are so bad that sales agents rarely use the term “annuity” any longer when selling them! Do not ever consider these types of annuities! They are loaded with hidden fees that get you when you sign in and again when you sign out of them after you realize what a big mistake you made signing in! If you or a friend ever get your hands on an annuity contract, rub some raw fish on it so it actually begins to smell as bad as is it! Rotten! Well, now I warned you.

There are however, two good types of annuities worth serious consideration to provide a steady, guaranteed monthly payment during retirement: Immediate Annuities and Longevity (deferred) Annuities. These 2 types of annuities are good for you, if you can afford them! They have little or no hidden fees. Also, these provide a versatile means of paying for daily living expenses, long-term care insurance,a second home, supplemental medical or dental insurance, supplement the grandchildren’s college education, or anything else your aged heart desires!

Basically, these 2 types of annuities work like this:

You agree in writing to give the insurance company a large, lump payment of about $130k or higher. Once you give it to them, the insurance company owns this money. In return, per your contract, the insurance company agrees to pay you a regular, guaranteed monthly payment for the remainder of your life. You would purchase an immediate annuity around age 75-80 and regular, guaranteed, monthly payments begin almost immediately. The older you are when you purchase them, the large the fixed, monthly payment amount. With a longevity annuity however, you should purchase it around age 60, but the regular, guaranteed, monthly payments begin much later, typically at age 85. The older you are when you purchase a longevity annuity, the smaller the fixed, monthly payment amount. With both types of annuities, the larger the lump payment, the larger the monthly payment. Generally, you should not invest more than 33% of your nest egg in an annuity.

It is your job to assess your financial situation, your health, genes, and expected retirement span to determine if either or both of these annuities are a good deal for you. You have the advantage that you know your biology. The insurance company has the advantage of having lifespan statistics of folks like you.

When considering one of these annuities, you must be sure to buy them from a sound, reliable insurance company that you can be confident will still be around in 30-50 years! AM Best rates insurance companies. You only want to buy insurance from companies having an AM Best rating of A++ or better. These are the cream of the crop that you must depend on. New York Life, Mass Mutual and Northwestern Mutual are 3 very sound insurance companies.

Also, be sure to add a compounded, 3% inflation “rider” (option, sometimes called “COLA” or Cost of Living Adjustment) to the annuity contract to prevent your monthly payments from shrinking over time due to inflation. Although inflation has been low for a long time, the cycle of life principle indicates that inflation rates will rise in the future. This option will cost you, but is necessary.

Also, you can get more for your money by getting a joint annuity that will reduce the monthly payment by 50% upon the death of the first of the couple

You will likely need to buy these through an insurance broker. The broker will show you a few options and insurance company offerings, and you select the one that makes most sense to you. The broker should rightfully be getting about 3.75% percentage fee for his/her service, but this fee should be built into the annuity, so it is of no concern to you as long as you read the annuity contract, including the fine print for any fees.

So, if you are seeking increased financial security and peace of mind during retirement, consider these 2 types of annuities for regular, guaranteed monthly income. An immediate annuity or longevity annuity with an inflation rider might be a solution to your long-term care expenses late in your life! If, by age 80-85, you still do not need long-term care, you can invest the monthly payment any way you like. You might invest it in an HSA account to cover current and future healthcare expenses, Roth IRA, CEF fund, MLP, dividend paying equity funds or stocks, or even your grandchild’s’ 529 college fund. The payment is yours (however, 2/3rds of it is taxable income). You need to total up your sources of potential retirement income, then determine the balance of the need to cover the expected costs of long term care. The daily cost of long-term care today is roughly $200 per person.

Umbrella Insurance

If your net worth is about $1 million or more, you are a potential target for persons seeking easy money via lawsuits. It is generally recommended that you get an umbrella insurance policy through one of your existing insurance providers. These policies generally offer coverage in $million increments. An umbrella insurance policy will cover any gaps or limits to your existing insurance coverage in the event that you are sued for causing some type of injury (physical, mental or emotional). A $1 million umbrella policy is very reasonably priced; however, a prerequisite to getting it is that you have liberal insurance coverage on your auto and homeowners insurance.

Direct Primary Health Care (DPC)

A growing number of primary care physicians are no longer accepting their patients’ medical insurance. Instead, they are operating their practices on a direct primary care subscription “membership” model that they claim allows them to spend more time with their patients and to provide better care.

Imagine paying a flat, monthly membership fee ($40-100+) for medical services with a quality, licensed physician. There would be no restrictions of any kind on frequency, types, or duration of office visits per month. Services might include unlimited 30-minute visits, home visitation, telemedicine, text messaging, annual wellness evaluation, after-hours access, and significant savings on advanced services such as labs, prescriptions, X-rays and other scans. There would be no pre-existing medical conditions, little or no waiting for appointments, less paperwork and less bureaucracy.

These subscriptions are best suited for people with chronic medical conditions requiring ongoing physician monitoring. DPC is not insurance, but is an excellent supplement to medical insurance, healthshare, or other healthcare plan.

To see an example of an exemplary direct primary care program, go to: Sentinel Primary Care or acchealth. To find a DPC doctor, you will need to do a little research. Try using Google Maps to search for “direct primary care physicians near me” (or near your city name). Then, after reviewing their web site, call a few to confirm they operate this way and ask a few specific questions. When I called our DPC physician for the first time she answered the phone herself, as she has no one working for her. She gave me her cell phone number and made herself available for care 24/7! Her services included all normal primary care physician services, plus discounts on lab, scans, and prescriptions. She offered a 10% discount for cash payments and another 10% discount for pre-payment. There was only a 10% fee for outside services.

Review Kiplinger’s explanation of what Medicare will and won’t cover during retirement.