I’m confident that you share my belief that taxes are a dull and complex topic, yet a very important one. Congress has made taxation a highly complex structure. Taxes come in many bitter flavors: postage tax, income tax, sales tax, estate tax, property tax, vehicle tax, social security tax, to name the most common taxes. They also come in federal, state, county and city varieties.

If you have a simple tax filing from just one state, you can file your Federal and State taxes FREE with tax audit support by credit karma!

Income Tax Myths and Insights

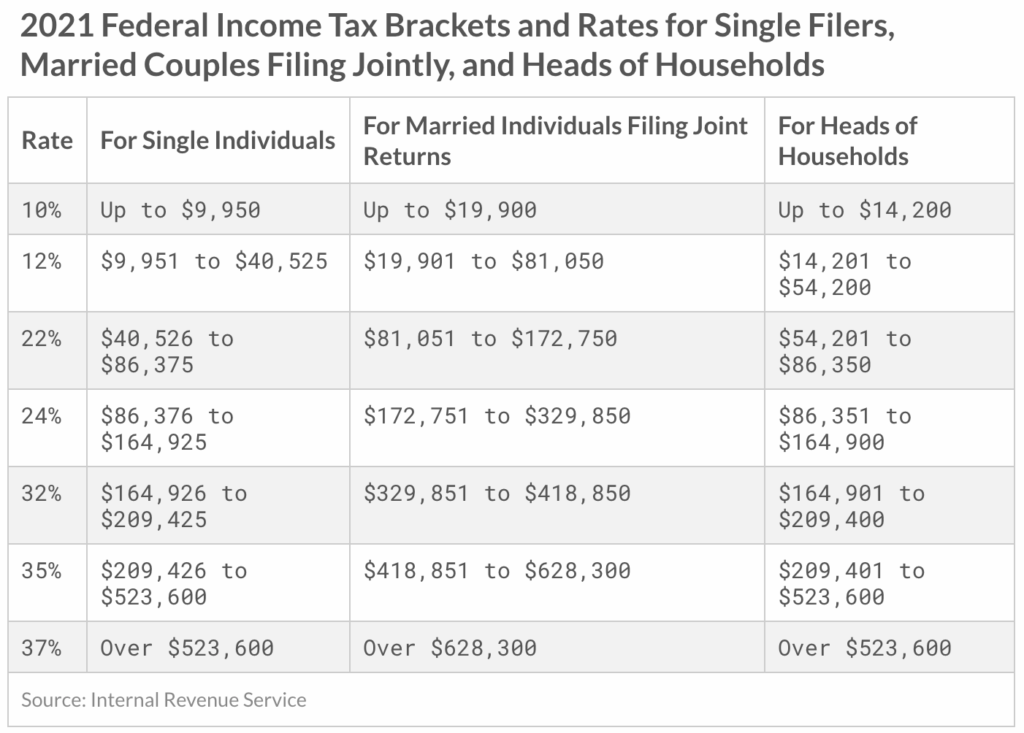

In an effort to make taxation compassionate (as well as confusing and political), Congress broke income annual tax rates into progressive categories, called “brackets.” So, a citizen who earned a higher income pays a higher tax rate assigned to a higher bracket than someone with a lower income. Each year, Congress has the power to revise these bracketed rates, so you must check these rates annually.

In 2021, the brackets are as follows:

Now, let’s follow an example to see how this taxation works:

If John’s (who’s married and filing jointly) income for 2021 was $175,000, notice that Congress placed him into the 24% tax bracket. If he had earned just $2,250 less in 2021, he would have been placed in the next lower, 22% tax bracket. Now, in case you’re thinking John will now have to pay the 24% tax rate for all of his income that year, you’re mistaken! John will only have to pay the 24% tax rate on the $2,250 that went over the limit of the 22% tax bracket! He’ll pay the 22% tax rate on the income he acquired between $81, 051-$172,750, and 12% on the money acquired between $19,901-$81,050, and 10% on the money acquired up to $19,900! That’s certainly good news!

The lesson to be learned is that you don’t need to fret too much over exceeding your income tax bracket, if the income is needed. If you can stay near the top of a tax bracket without exceeding it, that’s good! Be thankful you’re in a high income tax bracket!

Annual IRS Tax Refunds vs. Overpayments

Another common tax myth is that it’s better to receive a big, juicy lump tax return each April. It certainly feels great to get an annual bonus, doesn’t it! However, we need to look at this more closely with a concrete example. Let’s compare the strategies of Hap Ego Lucky and Shirley Savvy.

When Hap began his new job, while completing his W4 form, he chose to claim the lowest possible number of exemptions from withholding, hoping this would give him a big tax refund each April, which he would then use to buy an expensive toy or home improvement, or perhaps invest in his IRA.

When Shirley began her new job, while completing her W4 form, she chose to claim the highest possible number of exemptions from withholding, hoping this would give her a small, or no tax refund each April, or possibly a tax underpayment, but receive a larger paycheck every payday. She would then use this extra money to invest 10% of it into her IRA, save 10% of it over time for new toy or home improvement and apply the rest to pay her living expenses.

Unfortunately, Hap is living in ignorant bliss! What Hap doesn’t understand is that each year he allows his buddy, the IRS, to borrow and use HIS money all year long as they wish, interest free! Then give Hap back HIS own money each April, with no interest and no “thanks buddy.” Hap’s such a generous guy, but foolish!

Shirley made the most of her money by investing it in her IRA on payday every two weeks (a technique called “dollar cost averaging”), which allowed it to grow all year long!

Even if Hap had wisely invested 10% of his annual bonus into his IRA each April 15, (assuming an equal growth rate as Shirley’s IRA) Hap’s IRA would not have grown nearly as much as Shirley’s IRA! Just imagine Hap’s IRA if the stock market were to plummet soon after Hap had invested his big, juicy lump sum from his buddy, the IRS! Another detriment to overpaying your taxes is that it leaves a large chunk of your money in your IRS account for thieves to steal!

It really comes down to, who do you want to get the 12-month, interest-free loan, you or Uncle Sam? The lesson to be learned is that you should optimize the number of legally possible exemptions from withholding, and save and invest regularly using a dollar cost averaging technique with each paycheck. The IRS has an online calculator to help you estimate your optimal withholding amount. You can also talk to someone in the human resources or payroll department at work to adjust your withholding.

If you still like the idea of getting a big bonus each April, how about loaning me some interest-free money for twelve months? I’ll at least say “Thanks buddy!”

Incidentally, when filing your annual tax returns, doing it electronically is more secure and quicker than by paper/US mail, allowing you to get your big, juicy interest-fee loan back quicker!

Tax-deferred IRA’s vs. Tax-free Roth IRA’s

Here’s another tax tip for employees and retirees. If your employer gives you the option of opening a traditional IRA or a Roth IRA, which is better for you? The traditional IRA is tax-deferred while the Roth IRA is tax-free.

The traditional IRA does seem to offer an advantage of reducing your taxable income, as it is “tax deferred.” Tax deferred means that you can make Uncle Sam wait until you are retired to pay the required taxes on the money. However, the catch is that the money you’re going to have to pay tax on will have grown enormously, and creating an enormous tax bill!

Now, if you had the choice of paying a relatively small tax on a small, initial deposit amount or on a large post-growth amount, which would you rather pay Uncle Sam? I’d rather pay a small, pre-growth tax by using a tax-free Roth IRA!

And for employees who have one or multiple Rollover IRA’s, they can convert them from a tax-deferred traditional IRA to a tax-free Roth IRA by doing a “Roth conversion!” It’s as easy as filling out a form. You must pay a tax on the TOTAL balance being converted on the close of markets on the conversion date, but from there on, forever, all of its growth is completely and gloriously tax free! The sooner you do your conversion, the less conversion tax you will pay because your money is growing over time! I gradually converted my Rollover IRA to my Roth over a 3-year period to make my annual taxes more digestible, but each year, I’ve never paid an IRS tax with such giddy gleefulness! How I love beating the IRS at their own game!

However, if you’re approximately age 50, late in your career, close to retirement and have amassed a large amount of money over the years into a traditional Rollover IRA, it may not pay you to make a Roth conversion. If it does pay, you my choose to convert it gradually over a few years. In such cases, it’s wise to consult a tax account.

How High Income Taxpayers Can Legally Fund a Roth IRA

If your modified adjusted gross income (MAGI) is well into the six-figures, the IRS defines you as a high income taxpayer (and a big fish in the taxpayer pool who is getting away without paying your fair share of taxes!), and starts phasing out the amount of after-tax pay that you can contribute to a Roth IRA. If your individual annual income is more than $140k, or family income is more than $208k (in 2021), a Roth may not be for you, as individuals (in 2021) can’t contribute to a Roth if they earn $140,000 or more per year, or more than $208,000 if they’re married and file a joint tax return. But don’t give up in defeat! There is a little-known, legal, back door tactic to get around this Roth income limit! It’s called a “back door Roth.”

A Back Door Roth is not an account type, but an IRS-approved trick for high-income taxpayers to legally fund a Roth, even if their income exceeds the limits that the IRS allows for regular Roth contributions. There are a few ways that high income taxpayers can create and fund a backdoor Roth IRA:

1. Contribute money to an existing, traditional IRA, then open a Roth IRA account and roll the desired funds (part or all) over to your Roth IRA account, while maintaining your traditional IRA.

2. Convert your entire traditional IRA account to a Roth IRA account as explained above.

3. Open a Roth IRA account, then make an after-tax contribution to your existing 401(k) plan and then roll it over to a Roth IRA.

The custodial bank or brokerage for your IRA should be able to help you with doing this. If you’re dealing with a company 401(k), you can contact the financial services company that manages your company’s retirement savings plan.

Isn’t it better to pay a small tax now and stick it to the IRS rather than paying a large tax later and having them stick it to you? I think we’re on the same page here! With tax rates expected to rise in the near future, Roth conversions have become even more important and popular!

The lesson to be learned is that most employed Americans are better off with a Roth IRA than a traditional IRA and converting traditional IRA’s to Roth IRA’s, unless they have already amassed a very large tax-deferred IRA, but, personally, I wouldn’t let that deter me!

Investing vs. Trading Tax Consequences

In the investing world, there are two basic types of investors: buy and hold investors and traders. Byron Holder is a buy and hold investor. He buys a stock only after researching the company and holds it for 1-20 years or more for a long-term capital gain (15% in 2021). However, Tracy Turnover is a trader. She will buy a stock based on a hot tip in the news or a friend and sells it after a few seconds, minutes, hours, or days, hoping to make a quick, short-term capital gain (equal to the above federal income tax rates). However, after Tracy visits her tax account in April, and receives her tax bill, she gets the shock of the year! She has whopping tax bill from all of her sell transactions! What Tracy didn’t understand was that by selling a stock within one year, she must pay the IRA a hefty, (commonly 22%-24%) short-term, capital gains tax rate based on her annual income (see table above)! If Byron sells a stock after holding it for at least one year (366 days), he pays the IRA only a modest, (15%) long-term capital gains tax rate! Byron may even hold his stocks to his death and pass them onto his children by listing them as beneficiaries to his portfolio.

The lesson to be learned is that you should buy a stock only after researching it and commit to holding it for at least one year and probably several years, unless, of course, it turns out to be a loser!

By the way, speaking of losers, when selling stocks at a loss, your capital losses can be used to offset the taxes on your stock capital gains. This trick is called “tax loss harvesting” and your tax accountant can help you with this. Also, large capital losses can be carried over at least a few years into future tax years. Again, your tax accountant can help you with this trick.

Tax Credits for Dividends of Non-US Equities

Another little-known fact is that, if you hold a foreign equity (non-US stock, stock ETF or stock mutual fund) that pays dividends in a taxable, brokerage account, you can claim a foreign tax credit for the taxes on those dividends! The credit rate is based on which country the company is headquartered. This is not possible to do with equities held in retirement accounts. So, investing internationally and in emerging markets provides you with not just increased diversification, but a tax credit too! However, international and emerging market ETF’s and mutual finds typically have higher expense ratios (the cost of owning the asset). But, imagine, Uncle Sam providing investors with an incentive to invest their money elsewhere! Crazy, isn’t it? I wonder how many other nations do this!

Financial Account Beneficiaries vs. Will Beneficiaries

Now, consider this interesting scenario: If Byron lists his daughter Sarah as the sole beneficiary to his financial accounts (brokerage or IRA) with his brokerage firm, but later, with a memory lapse, lists his son James as the sole heir to his financial accounts in his will, what do you think will happen to Byron’s financial accounts upon his death? Sarah will receive Byron’s financial accounts! This is because a beneficiary designated to a specific account legally overrides any notarized statement in a will, even if the will was signed, dated and notarized the day before Byron passed away!

Results Upon the Death of an Account Owner

Now, assuming that Byron had properly listed each child as beneficiaries (50% to Sarah and 50% to James) to each of his financial accounts when he first opened each account, another interesting thing then happens to the cost basis (original sale prices) of each of Byron’s assets. When the IRS receives a copy of Byron’s death certificate, the IRS adjusts or resets the cost basis of each of Byron’s assets to their market value at the close of the markets on Byron’s death date. Read that again so it sinks in. Effectively, it’s as though the beneficiaries, Sarah and James, had purchased the assets themselves on the evening that Byron died! This means that Sarah and James become the legal owners to an appreciated set of assets that they could choose to hold, or sell with no (ZERO) taxation, except for any appreciation that occurs after Byron’s death date (unless the children live in a state that has an estate tax). This is how great family wealth can and should be transferred from one generation to another!

Of course, Byron should list his spouse as the primary beneficiary and his children as contingent (secondary) beneficiaries. The lesson to be learned is that you should immediately assign your primary and contingent beneficiaries per each financial account and also maintain a legally-recognized will that is consistent with your account beneficiary designations.

You should also review and update your will and account beneficiaries regularly, about every 5-8 years as your children mature, and upon each major life event, such as the birth, death, marriage or divorce of a spouse or child or, sadly, their development into financially irresponsible adults. In such sad cases, consider setting up a trust for them or for an organization that you revere. Personally, my rule for bequeathing wealth is not to give any irresponsible child (regardless of their age) wealth they have not earned according to my standards of personal, familial and financial responsibility. It can be like handing a toddler a loaded pistol! Poverty and hardship are often effective motivators to developing character, maturity and responsibility. It’s a great irony of life that we naturally want our children to have an easy life, but such ease actually stifles their development of character, maturity and responsibility. Think about it, hard. It was James Dobson who wrote the book, “Parenting Isn’t for Cowards.” I encourage you to commit to be a courageous parent, follow God’s unchanging, absolute standards and not follow the neighbor’s fickle standards and practices, even if you must stand alone.