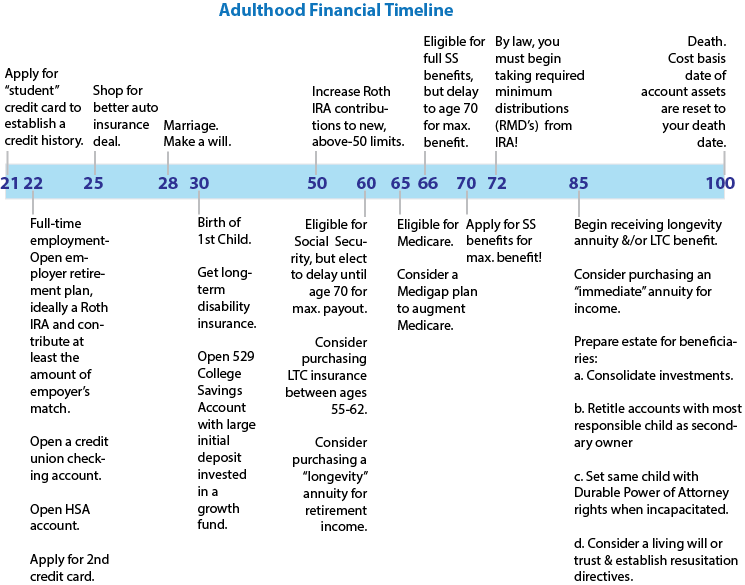

Everyone experiences major life events throughout their lives. Major life events cause major changes in our lives and create new responsibilities: graduation from high school, graduation from college, a new job, marriage, birth of a child, divorce, retirement, death of a spouse, and yes, your death too. Such life events can be stressful and overwhelming if we are not prepared for them. It is important that we carefully and proactively plan and prepare for these major life events, but most people do not plan for such life events. How can we plan for such life events? We might discuss expected life events with our family and friends. Below are considerations for major life events that will inevitably occur.

Everyone experiences major life events throughout their lives. Major life events cause major changes in our lives and create new responsibilities: graduation from high school, graduation from college, a new job, marriage, birth of a child, divorce, retirement, death of a spouse, and yes, your death too. Such life events can be stressful and overwhelming if we are not prepared for them. It is important that we carefully and proactively plan and prepare for these major life events, but most people do not plan for such life events. How can we plan for such life events? We might discuss expected life events with our family and friends. Below are considerations for major life events that will inevitably occur.

College Graduation & Start of a New Career Life Event

Graduation from college is an exciting life event, with many new changes in your life! A new career and job, a new residence, a new car, new friends. It also brings a new paycheck, a new 401k retirement plan, and new bills. If you haven’t learned about personal finance yet, now is definitely the time to learn how to manage that new paycheck!

Soon after starting your new career and job, you will need to select where to invest some of your money into an employer-sponsored 401k retirement plan. If your employer offers to match your contributions, then match it to the max! This is free money and is like getting an immediate pay raise! Then open an individual Roth IRA and contribute some money to that, (perhaps $100 per paycheck ($200/month). Your 401k will reduce your income taxes and grow tax-deferred until your are retired, and your Roth IRA will grow tax-free for life with no taxation whatsoever!

These 2 investments will prove to be the two most important investments you will ever make in your life! That’s because of the tremendous power of compounding over time. You see, by starting these investments now while you are young, they will have the time to grow enormously (and effortlessly) over 40 years to retirement, and beyond retirement! That is, if you prefer to retire and enjoy life around age 50-62 and preventing having to work until you are 70-80 years old! This is no exaggeration my friend! Your early and wise planning and investing will alter your life! Be a smart citisumer and start saving for retirement NOW! And never, ever take this money out for anything but retirement spending. NEVER! Uncle Sam will tax you big-time and you will not have enough money to retire!

However, if your employer doesn’t offer a match to your contributions, then just open a Roth IRA and contribute about $200-$400/month.

Birth of a Child Life Event

Upon the birth of a child or grandchild, it would be smart to immediately open a 529 colleges saving s account to being investing in the child’s college education. I recommend making an initial deposit of about $25-30k monthly over a 6 month period. If this is your child, you can also make a small, monthly contribution of about $30-$50. If this is for your grandchild, then encourage your adult child to make these contributions. This will ensure that your child can afford to attend an excellent college one day. 529 college savings plans are actually tax-free investment plans that are regulated by states. You can open a plan that is hosted by your state, but you are not restricted to your own state. You can open a plan hosted by any state. Many states have multiple plans. The quality of the plans within and between each state is far from equal. There may be tax benefits by opening a plan hosted by your state, but it is worth comparing your states best 529 plan with the best plan from a few of the best states. You can identify the best plans of the best states at Clark.com.

Currently, you can legally change your investment allocation twice per calendar year, so choose a fund carefully for the long-term (you can thank Congress for acting as your protective mother here). Invest in one, broad-market, large cap growth stock fund that has performed well for at least 5 years. After 4-5 years of growth, consider diversifying into 2-3 funds to reduce risk. If possible, contribute a small amount (perhaps $50 monthly) to it with each paycheck, but these contributions must never trump your retirement contributions! By the time they are ready for college, they should have the majority, if not all of the money for it. If the child chooses not to attend college, you can change the beneficiary to another person.

TIP! – While we are on the subject of education, if, during your childs’ elementary school years they show signs of being average or below average in their academic performance, and doctors find no clinical abnormality, this is probably just immature brain or social development that is fairly common. There is a simple and effective cure for this: Hold your child back to repeat their grade. Research shows that this will move your child up in performance, and even set them up to become a class leader for the remainder of their education. This will also give you an extra year to enjoy your child before s/he goes off to college, and give you one more year to save for college! So what if they enter the workforce a year later! What’s the rush? They will probably start with a better job and advance higher than otherwise! If you are concerned with the stigma associated with such a move, then it is time to give your attitude a tweak, shrug it off, because it is totally unfounded. More parents are learning this truth each year.

Retirement Checklist

Just prior to retirement or semi-retirement, visit with a certified financial planner and prepare to adjust your portfolio to make the switch from growth to income.

Upon your retirement life event, sit down with your spouse and explain a summary of all of your financial information.

- Create a spreadsheet file to list and manage all accounts, assets and property of the deceased.

- Share this document with your spouse. Give her a printed copy for her to store.

- Place this document and all other important documents into 1 folder and clearly label it “Documents to review immediately upon my death”. Place this folder somewhere where your spouse will not miss it upon your death and inform him/her of its location, regularly. Include in this folder your will, account spreadsheet, financial manager names, contact information, account URL’s, user names, passwords, veterans certificates, insurance policies, safe deposit box keys and numbers, etc.

- Resist the temptation to begin collecting Social Security income immediately, and if you can afford it, wait until the oldest age the government will permit you to delay (currently age 70), if you expect to live well past age 80. If you do not expect to live much longer than age 80, then delay your SS benefits until the “full” retirement age of 66. This will tremendously increase the amount of income that Social Security will provide you, for life. Again, free money!

- If you estimate that you will need more income later in life than your investments and social security will provide, consider purchasing a longevity annuity or immediate annuity, but no other type of annuity!

Late Stage of Life Checklist

Another major life event late in life, around age 80-85, while you are still mentally competent and your children have matured (and using their heads well), identify a highly responsible child, child-in-law or long-time friend to assist you with these tasks, sit down with her/him and explain your wishes. Never enlist a recent friend for this!

Another thing you might want to do is to identify any assets that you think would be good for your beneficiary to sell immediately after receiving their inheritance. You see, all cost bases of all capital gains are reset upon your death date, so your beneficiaries could potentially sell them all with near 0 taxes! But, you may want to keep this fact a secret from your beneficiaries, as it may be tempting for them to sell everything! But, if there are any assets that have a very high unrealized capital gain, consider whether your beneficiary should hold or sell them immediately. They would take a large tax hit if they sold them years after your death.

Financial Preparation for Death and Estate Transfer

The death of a loved one of an extremely difficult life event. There are many important things that need to be done, some while you are deeply grieving and not thinking clearly. Some of these things should not be done until you are past the deep grieving stage and are thinking clearly again. Other things should be done well in advance of your parents, your spouses, or your own death. It takes courage to prepare for this inevitable event. Below is a checklist to review before and after the death of a spouse. Do not leave your spouse ravaging through your unfamiliar files looking for documents s/he doesn’t even know what to look for, while balling their eyes out in deep grief, and cussing you for not making this dreadful task easier!

Checklist Upon Death of Spouse 1

- Check for accounts and assets and safe deposit boxes in deceased name only and retitle in survivors name only.

- Acquire 10-15 copies of the death certificate. (The first 10 should be free).

- Send a copy of the death certificate to each institution having an account with the deceased.

- Retitle accounts, assets and property to the surviving spouse name.

- Consider adding a highly responsible child’s name as secondary owner of all accounts. This will enable you to avoid probate court upon the death of spouse 2.

- Stop insurance and subscriptions of the deceased spouse.

- Sell any extra property not needed by the survivors, after several months have passed, when you mind is clear and rational again.

- Rollover deceased spouses IRA to survivors name, in-kind, without cashing in, with help from a certified financial planner.

- Redeem any forfeited property that may exist.

- Cash out of all life insurance, healthcare policies, annuities in deceased spouses name.

- View the deceased spouses safe deposit box and restore these items responsibly.

- Update the survivors’ will and beneficiaries with an attorney.

- Stop Social Security, pensions, Medicare, Medicaid, and Veterans Disability payments.

- Either set up a trust with a local credit union or bank to the pay survivors bills, or have a responsible child take this responsibility.

- Transfer cash from state Treasury holdings to survivor.

- If the deceased is a veteran, locate their honorable discharge certificate and send a copy to your funeral provider to receive an honorable veterans burial.

- Change mailing address of all deceased accounts to responsible child if spouse cannot manage them.

Checklist Upon Death of Spouse 2

- Review the above checklist again.

- If the deceased had placed a deposit on a room in a nursing home, have the deposit refunded to you.

Transferring Wealth to the Next Generation

If you are in a later stage of life, have accumulated a large amount of money over the decades and wish to transfer it to your children tax-free, there is a way. Under current tax laws (which can change annually by Congress), you can give anyone (children, friends, strangers) up to $15,000 cash annually as a tax-free gift. This means that you could give your child $15,000 and your spouse could do the same. You could also give your child’s spouse $15,000 and your spouse could do the same, effectively giving the couple $60,000 each year, tax-free! Now, Assuming your adult children are responsible with money, this could work very well, provided you place some personal conditions to these gifts, such as stipulating that the money be invested responsibly into an IRA, HSA, 529 college saving fund, or used to pay off their mortgage or purchase a second home. You could stipulate they do some of all of the above.

However, you need to be very cautious about this strategy, as it could result in unintended consequences. Beware that your child is under no legal obligation to use/invest the money as you stipulate. Also, such a large gift could easily corrupt your responsible child’s mind and attitude, making them less responsible with their life. Someone once said that “cocaine is nature’s way telling you that you have too much money!” An easy life naturally becomes an irresponsible life of leisure! You have to ask yourself honestly, “How would my child handle an easy life?” If your child is financially irresponsible, this could be like handing a toddler a loaded pistol!

Probate

Unfortunately, dying is a big responsibility today! The granting of probate is the first step in the legal process of administering the estate of a deceased person, resolving all claims and distributing the deceased person’s property under a will. A probate court decides the legal validity of the deceased person’s will and grants its approval to the executor.

Probate is the judicial process where a deceased person’s will is validated in a court of law and accepted as a valid public document that is the true last testament of the deceased, or, in the absence of a legal will, the estate is settled according to the laws in the state of residence of the deceased at time of death. If you’re an only-child beneficiary or a beneficiary with power of attorney rights, and honest, reasonable siblings, then you definitely don’t or want need probate! But if you expect family trouble dividing up your siblings’ due inheritance, then you may need a probate judge to do the dirty work for you if don’t want to divvy up your remaining family relations along with your inheritance.

If you happen to live in a state with an estate tax, and you have a responsible child, then a trick to getting around the probate process (but not the tax) is to retitle your accounts (while you’re still mentally capable), with yourself as the primary owner, and your responsible child as the secondary account owner. Then, appoint the responsible child with “Durable Power of Attorney” or “POA” rights and responsibilities. The word “durable” is critical, as there are less powerful levels of POA’s. The person appointed POA has power to sign for you as though they are you. The person with POA also has the right and responsibility to divide up your accounts among siblings, etc. (if you previously communicated this in your will). By taking these measures, your responsible child will receive your accounts immediately upon your death, and bypassing probate court. By not taking these measures, the county will likely freeze and sit on your accounts for 1-2 or more years, as the county attorneys try to determine who is the legal owner of your accounts!

Get more info on wealth transfer.